tax saving tips for high income earners uk

Interest from cash in ISAs and NISAs will be paid completely tax-free. Book Your Free 60 Minute Assessment Now.

Tax-Saving Tips for Business Persons.

. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Here are five tax saving tips that are easy to apply. No tax shall be deducted from.

Distribution of Profit in Partnership Firm. The number indicates your Personal Tax Allowance for the year divided by ten. Look at the example below.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. We offer one-off personal tax advice from an accredited accountant especially for high-earners. Find Helpful Tips Along The Way Like Which Debts to Pay First and How Much To Pay.

You probably should be. Whether youre getting your head around adjusted net. Tax Saving Strategies for High-Income Earners.

Paying into a pension is one of the most tax efficient ways to save for retirement. Establish retirement accounts One of best ways for high earners to save on taxes is to establish and fund retirement. Yes British high earners really do pay significantly less income tax than their European counterparts with the 80000 earner taking home as much as 8000 more than.

So if you earn 13570yr you could then get a further. We Work With Trusted UK Advisors. You can calculate the total amount of income you can earn in a year ie.

As long as youre a UK. Here are a number of ways those with high incomes can invest tax-efficiently. Since 2001 the Shares Awards have recognised the high quality of service and products from companies in the world of retail investment as voted for by Shares readers.

Start a conversation on our Live Chat if you have questions on this or. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. The most common way is to pay into a pension which will reduce your tax bill by the top.

Anyone with a taxable income of more than 240000 will also see the annual allowance for their pension tapered for every 2 of income earned over 240000 their. To find your combined tax-free allowance subtract your annual income excluding anything you earn from savings from 18570. Heres a list of tax-saving options for a business person.

If you are an employee and you have an employer-sponsored 401 k or 403 b in 2018 you can contribute. Nothing More Nothing Less. This means your allowance is zero if your income is 125140.

Ad Get The Financial Advice You Want. There are various ways to reduce your income resulting in you paying less tax. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850.

One of the most effective ways for high earners in the UK to build wealth. Get FREE access to my E-BOOK 3 TRAINING VIDEOS with vital tax saving tips. 401 k or 403 b.

Financial planning tips for high earners Make the most of your pension allowances. Although the exemption is 5120000 this year its currently scheduled to fall to 1000000 with a 55 rate next year unless Congress and the. For high earners the tax perks are even more attractive.

Book A Free Consultation. 50 Best Ways to Reduce Taxes for High Income Earners 1. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget.

Dividends income is usually taxed at 325 for a higher-rate taxpayer and 375 for an additional-rate taxpayer. Your Personal Allowance goes down by 1 for every 2 that your adjusted net income is above 100000. Ad Enter Your Postcode To Find A Local Financial Advisor.

ISAs Individual Savings Accounts Your first thought should be for an Individual Savings. Specifically contribute to a traditional 401 or IRA. Within your annual Personal Tax.

Student Loans Boss Steve Lamey Hired Against Advice Universal Credit The Borrowers Pay Rise

24 Best Personal Finance Books Budget Save Money Reduce Debt Personal Finance Books Retirement Planning How To Plan

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

How To Make 2020 Your Best Money Year Yet According To 9 Self Made Millionaires

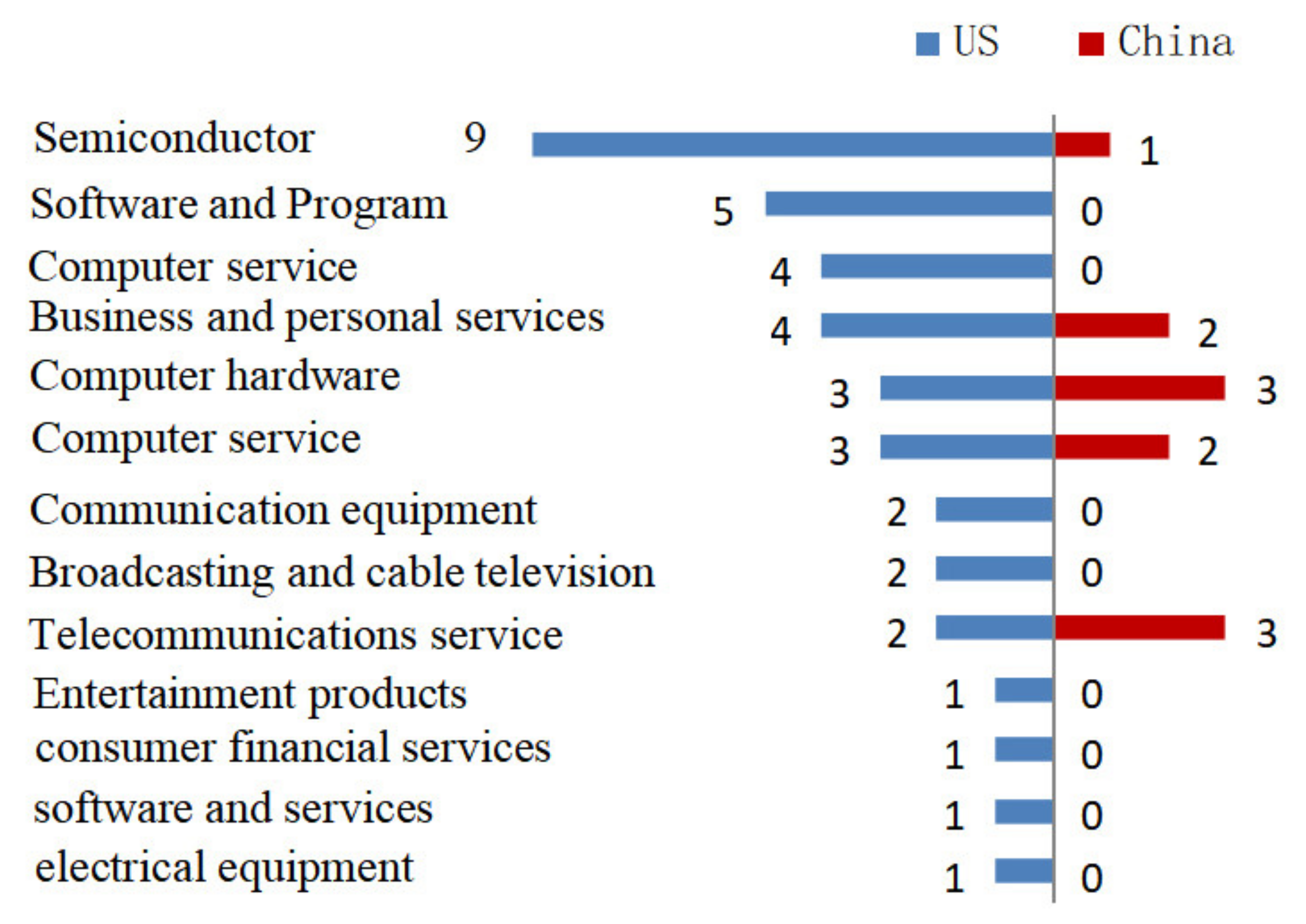

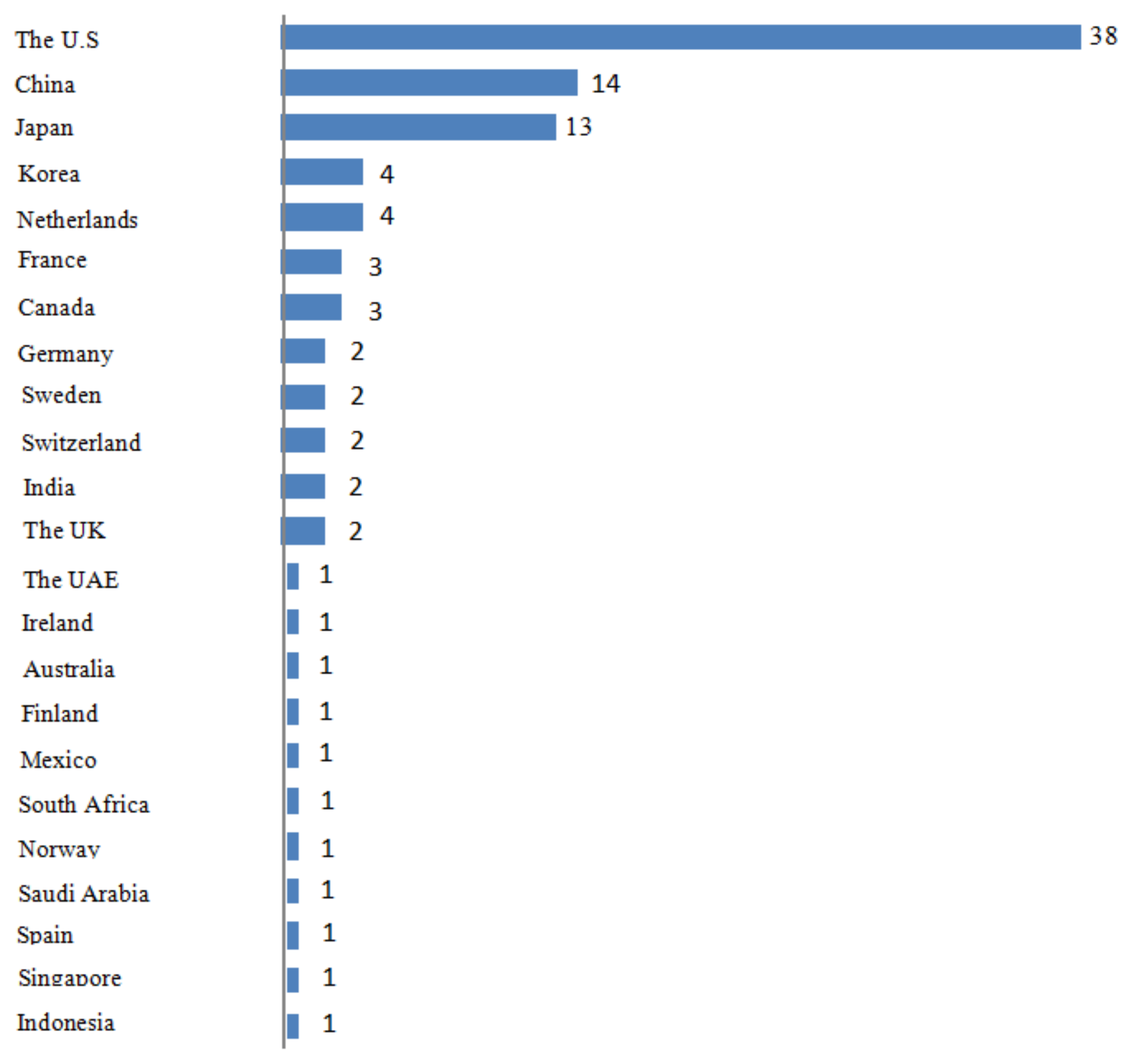

Sustainability Free Full Text The Effects Of Tax Reduction And Fee Reduction Policies On The Digital Economy Html

Sustainability Free Full Text The Effects Of Tax Reduction And Fee Reduction Policies On The Digital Economy Html

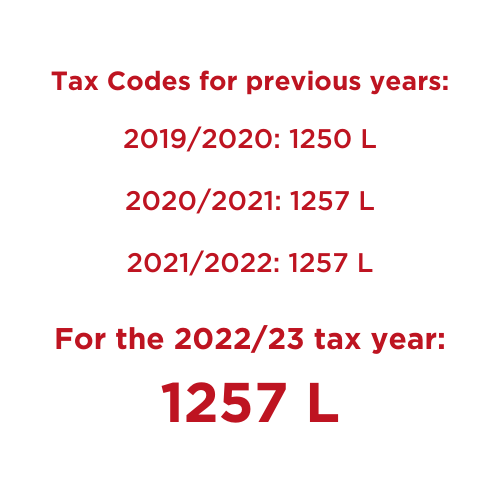

Tax Codes Explained Hmrc Tax Code Faqs Rift Refunds

Is Your Total Income 51 Lakh You Pay Tax Only On 50 Lakh Here S How Mint

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

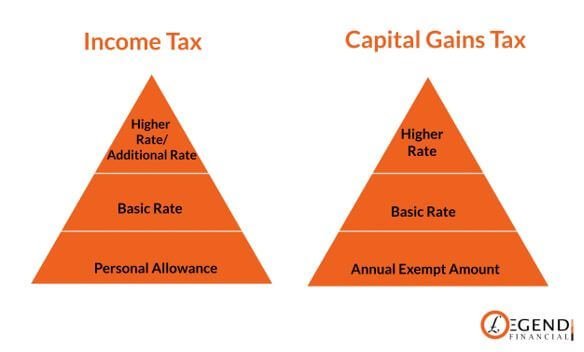

How Much Is Capital Gains Tax On Property Legend Financial

Pin On Best Of The Millennial Budget

What If I Am A Cross Border Worker Low Incomes Tax Reform Group

I Will Post Your Uk Deal On Latestdeals Guaranteed Marketing Strategy Marketing Services Deal Sites

Why Do Europeans Pay Such High Taxes Germans Pay 60 Quora

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor